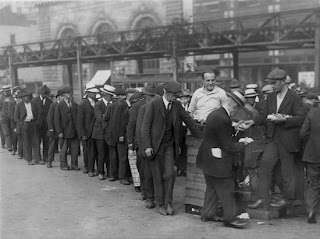

After the start of the Great Depression, the US government adopted a number of regulations, institutions, and safety-net policies designed to prevent a recurrence of an event that nearly destroyed capitalism and liberal democracy.

In the 1980s and 1990s, many of those regulations, institutions, and safety-net policies were eliminated or curtailed. Some call this the triumph of capitalism and freedom over excessive government regulations, others call it “the great risk shift.”

Now, I’m not saying any of this is directly responsible for the fact that our financial system is teetering on the edge of total collapse at the same time that an enormous number of people are one paycheck away from poverty.

But it certainly is food for thought.

Oh, wait. Look! Over there! A pig with lipstick is attacking some lobbyists!

… What was I talking about, anyway?

PS: Oh, yeah. The financial crisis. My wife made an interesting point last night: “The government’s basically said that Lehman Brothers is below the threshold for being ‘too big and important to fail.’ So if you were a stockholder or creditor at an investment bank–or any other financial institution–that was smaller than Lehman, and you got a hint that it was in trouble, what would you do?'”

Image source: Encyclopedia Britannica.

Daniel H. Nexon is a Professor at Georgetown University, with a joint appointment in the Department of Government and the School of Foreign Service. His academic work focuses on international-relations theory, power politics, empires and hegemony, and international order. He has also written on the relationship between popular culture and world politics.

He has held fellowships at Stanford University's Center for International Security and Cooperation and at the Ohio State University's Mershon Center for International Studies. During 2009-2010 he worked in the U.S. Department of Defense as a Council on Foreign Relations International Affairs Fellow. He was the lead editor of International Studies Quarterly from 2014-2018.

He is the author of The Struggle for Power in Early Modern Europe: Religious Conflict, Dynastic Empires, and International Change (Princeton University Press, 2009), which won the International Security Studies Section (ISSS) Best Book Award for 2010, and co-author of Exit from Hegemony: The Unraveling of the American Global Order (Oxford University Press, 2020). His articles have appeared in a lot of places. He is the founder of the The Duck of Minerva, and also blogs at Lawyers, Guns and Money.

0 Comments