Much ado. Investors keep getting burned in betting on the exit of members of the Eurozone, let alone the breakup of the currency/monetary union of the EU. And econ/business experts keep getting their predictions wrong. The simple reason: the EU, from its econ/financial area to the vast array of its other policy areas, at heart is a political project. Events continue to show that despite the painful strains of major economic duress, this commitment remains intact.

Despite the messy manner in which its member state governments deal with crises–largely explained by institutional reasons, less so by incompetence–the EU and the euro are around for good. The EU certainly has some major restructuring to do in terms of necessary banking and fiscal unions, and it rarely looks good in a crisis. But it will carry on muddling through its challenges and in a wider historical perspective continue to provide its citizens with a considerable range of benefits. Just as it has for decades, particularly since the advent of its single internal market nearly 30 years ago.

Nonetheless, the EU made major mistakes in the bailout of Cyrus and nearly botched the entire thing. Even worse, the whole affair demonstrates a distinct inability to act strategically when the stakes are high. Repercussions from this episode that haven’t been captured in the headlines will continue to reverberate for years. Surprise, it was politics that accounted for bringing back the specter of crisis, not economics.

The Cypriots are certainly responsible for a range of significant mistakes on their own: for years the government artificially propped up its economy with illicit capital inflows primarily from Russian businessmen; it allowed its banks to grow too large in the process; it didn’t develop other facets of a standard western economy; and during this crisis recently elected President Anastasiades engaged in unhelpful brinkmanship in a failed attempt to keep the country’s business model intact.

But did these actions justify the harshness of the final deal and the risks that lay ahead for the EU? It would appear not.

Conventional wisdom suggests the newly harsh approach of the EU finance ministers toward Cyprus–compared to previous bailouts during the euro crisis–was due to average citizens in Germany and elsewhere being fed up with having to stomach a lifeline being thrown to yet another profligate southern European member state. In fact, the more accurate explanation traces the cause to the bitterness northern European political elites still nurse from the early 2000s when Greece blackmailed the member states at the time into bringing Cyprus into the Union (Greece threatened to veto Scandinavian aspirants lest Cyprus be allowed to enter as well) as well as a touch of anti-Russian sentiment.

These overriding political factors led EU policymakers to a glaring economic mistake : the bogus idea to bail-in insured citizen depositors to begin with. The EU intended merely to tax Cypriot insured deposits under 100K euros, but it didn’t have the wherewithal to realize investors/observers would interpret this as a haircut–extracting a pound of flesh by fiat. This, rather unnecessarily, brought the euro crisis that everyone thought was largely over roaring back. There was nothing necessary about this; it was an abject mistake. The EU was so bent on putting the boot on the Cypriot neck that it neglected to think through the acute danger of setting off bank runs around the region, by violating its own banking deposit guarantee. As an example of group think, it was a thing of beauty.

Despite a final deal that preserved the bank deposit guarantee, the genie has escaped the bottle. And that’s the thing about genies; they don’t go back in. It is going to be far more difficult to put a banking union into place on top of this wreckage. But it gets worse.

In strategic terms the EU hurt not only Cyprus and itself, but also the interests of the U.S. and other allies in the West. First, as already alluded to the EU harmed its own reputation significantly and undermined its own deposit insurance guarantee. Second, it spooked global financial markets and gave the largely false impression that the euro crisis had returned. Third, it did serious damage to prospects for a properly organized banking union, which must of course have a bank deposit guarantee at its core.

Fourth, and more serious, the EU pushed Cyprus directly into the arms of the Russian government; this hurt the prospects for its own deal, but gave leverage to Moscow in the process. Fifth, and more important still, by forcing Anastasiades between Scylla and Charybdis the EU seriously undermined him domestically precisely when the West was about to reap the benefits at long last of a fairly pro-Western Cypriot president–crucially necessary to overcome sour relations with Turkey that continue to undermine NATO relations, EU relations, NATO-EU relations, and U.S. relations with both (at a time of intense security challenges). To top it all off, a peace deal along the lines of the Annan Plan for a final resolution of the 40 year-old Cypriot split, that was coming back into serious consideration with the election of this President, has had its prospects diminished.

It is a myth that Anastasiades alone was responsible for at first wanting to give average citizens a haircut despite not being responsible, for the Germans were complicit and actively in support (despite subsequent denials). But it is also a myth that Germany alone was pressuring the Cypriots, as the Finns and the Dutch were equally adamant along with the ECB and the IMF. Each bears a degree of responsibility for this debacle, including inside Germany the SPD party (who, ironically enough, pushed harder than Chancellor Merkel’s Christian Democrats).

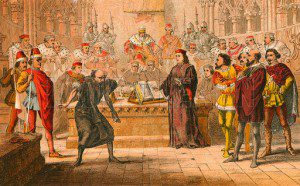

In “The Merchant of Venice” Shylock only hurt himself by his overzealousness, forfeiting a great deal in the end despite initially being in the right. How prophetic.

Dr. Jeffrey A. Stacey is currently Managing Partner of Geopolicity USA, an overseas development firm. Formerly he was Senior Fellow at the Center for Transatlantic Relations at SAIS, before which he served in the Obama Administration as a State Department official specializing in NATO and EU relations at the Bureau for Conflict Stabilization Operations. At State he founded and managed the International Stabilization and Peacebuilding Initiative (ISPI), which has over 20 government and international organization partners.

Dr. Stacey is the author of "Integrating Europe" by Oxford University Press and is currently working on a follow-up book entitled "End of the West, Rise of the East?" He has been a guest blogger at The Washington Note and Democracy Arsenal, a professor of U.S. foreign policy at Tulane University and Fordham University, a consultant at the Open Society Institute and the U.S. Institute of Peace, and a visiting scholar at George Washington, Georgetown, and the University of California. He received his PhD from Columbia University.

I have vague recollection that when we asked IR faculty in 2011 TRIP survey whether the Euro-zone would collapse (or lose members), the IR scholars from the IPE sub-field were more pessimistic (and wrong so far), while the area studies, constructivist, and EU studies respondents were more optimistic that Euro-zone would weather the storm. You only allude to this at the beginning of the post, but I think you are on to something. In 2010 or 2011 I also spoke to an economist who had just done a survey of a bunch of European macro-economists. They were all very pessimistic. Something here about professional training and/or about underlying models of human behavior that inform different social scientists.